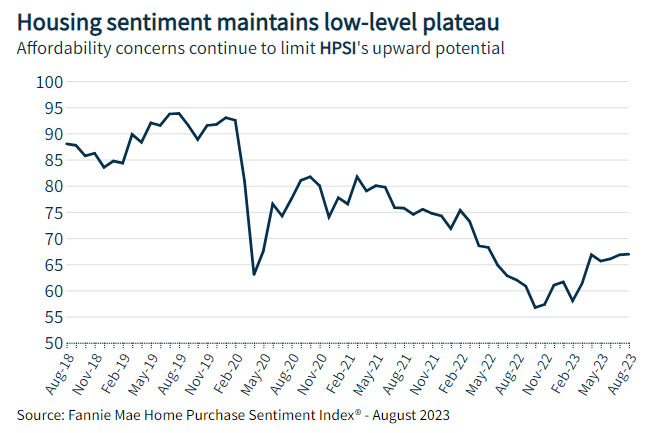

Unusual Housing Market Dynamics Contributing to Stall in Consumer Sentiment

HPSI’s Low-Level Plateau Continues as Consumers Remain Frustrated by Lack of Affordability

The Fannie Mae Home Purchase Sentiment Index® (HPSI) remained effectively unchanged in August, as consumer confidence toward housing continued along the low-level plateau set earlier this year. Three of the HPSI’s six components increased month over month, most notably the component measuring perceived home-selling conditions. In August, 66% of consumers reported that it’s a good time to sell a home, compared to only 18% who said it was a good time to buy a home. Additionally, despite the significant rise in rates over the last couple years, only 18% expect mortgage rates to go down in the next 12 months. Overall, the full index is up 4.9 points year over year.

“Mortgage rates once again breached the 7-percent mark in August, hitting a 22-year high and doing no favors for consumer sentiment,” said Doug Duncan, Fannie Mae Senior President and Chief Economist. “Consumers remain pessimistic toward the housing market in general and homebuying conditions in particular. The overall HPSI is maintaining the low-level plateau set a few months back, and we don’t see much upside to the index in the near future, barring significant improvements to home affordability, which we also don’t expect. While renters are slightly more pessimistic than homeowners, for two years now a large majority of both groups have told us that it’s a bad time to buy a home, and they’ve continuously cited affordability concerns as the primary reason. If mortgage rates remain elevated, many existing homeowners will likely continue to hold on to their current historically low mortgage rates, suppressing existing home listings and providing support for home prices – assuming mortgage demand maintains resilience despite the higher rate environment. Considering that existing home sales have traditionally represented approximately 85-90% of total home sales, even substantial quantities of new home production are unlikely to produce the inventory needed to meaningfully improve affordability.”

Duncan continued: “From a historical perspective, the current housing market is unusual, as demonstrated in part by the HPSI and its recent plateauing. Given the significant home price appreciation and rapid rise in mortgage rates, it is very much a tale of two markets, at least from a consumer perspective. Of course, a third perspective exists among homebuilders, who are currently thriving amid the surge in demand for new home construction, a function of the unusual dynamics at play in the existing home space between would-be sellers and would-be buyers, as well as changing labor market dynamics owing to the ongoing prevalence of remote work. In the past, first-time homebuyers typically sought to purchase existing homes, which were generally more affordable than new homes. They then invested sweat equity before moving further up the housing ladder, often in response to an expanding family or another significant life event. However, Baby Boomers’ desire to age in place and the impact of the ‘lock-in effect,’ in which existing homeowners are disincentivized from listing their homes for sale because their existing mortgage rate is well below current market rates, across demographic groups – but particularly among Gen Xers – has thrown a wrench into this historical cycle, making it more difficult for would-be homebuyers to find affordable existing home purchase options. This is driving demand toward newly constructed homes, which, again, has been great news for homebuilders and the larger economy, at least to this point.”

On the right rail of this webpage, you will find a news release with highlights from the HPSI and National Housing Survey results, the latest Data Release highlighting the consumer attitudinal indicators, month-over-month key indicator data, an overview and white paper about the HPSI, technical notes providing in-depth information about the National Housing Survey methodology, the questionnaire used for the survey, and a comparative assessment of Fannie Mae’s National Housing Survey and other consumer surveys.

Article from Fannie Mae Housing Survey, Sept 2023